Finding affordable car insurance can often seem daunting. With an overwhelming number of providers and policy options available, many individuals wonder who has the best car insurance rates. This article aims to break down the key elements of car insurance, spotlight top providers, and offer actionable insights for consumers looking to save money while ensuring adequate coverage.

Toc

Identifying Your Car Insurance Requirements

Understanding Coverage Types

Before delving into identifying the best car insurance rates, it’s essential to understand the various types of coverage available. At its core, car insurance typically consists of several key components:

- Liability Coverage: This is a mandatory coverage that helps pay for damages and injuries you may cause to others in an accident where you are at fault. States have minimum requirements, but higher limits are often advisable for better protection.

- Collision Coverage: This type of coverage pays for damages to your vehicle resulting from a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: Unlike collision coverage, comprehensive insurance protects against non-collision-related incidents such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage is crucial if you are involved in an accident with a driver who does not have insurance or whose insurance is insufficient to cover your damages.

- Medical Payments Coverage: This covers medical expenses for you and your passengers, regardless of who is at fault in an accident.

Factors Influencing Insurance Rates

Numerous factors affect car insurance premiums. Understanding these can help consumers find who has the best car insurance rates for their specific situation. Key elements include:

- Driving History: Your past driving record plays a significant role in determining your rate. Accidents, speeding tickets, and DUIs can increase premiums significantly.

- Demographics: Age, gender, and marital status can influence rates. Younger, less experienced drivers typically face higher costs due to a greater likelihood of accidents.

- Location: Where you live matters. Urban areas tend to have higher rates due to increased traffic and crime rates. For instance, inquiries like “who has the best car insurance rates near Arizona” or “who has the best car insurance rates near Colorado” will yield different results based on local market dynamics.

- Vehicle Type: The make and model of your car can impact your premium. Sports cars or luxury vehicles generally come with higher rates due to their repair costs.

- Credit Score: In many states, insurers use credit scores to assess risk. A lower credit score could lead to higher premiums, as insurers believe that those with poor credit histories are more likely to file claims.

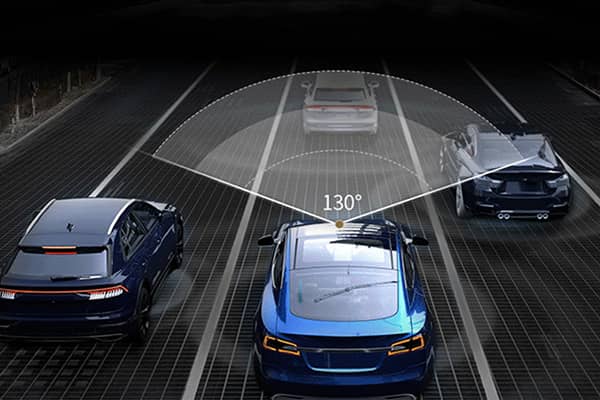

Telematics and Usage-Based Insurance

Moreover, a growing number of insurers utilize telematics, or usage-based insurance (UBI), programs. These programs track driving behavior through mobile apps or devices installed in vehicles. Safe driving habits, such as maintaining consistent speeds and avoiding harsh braking, can lead to discounts of up to 30%, according to a 2023 study by the Insurance Information Institute. Conversely, risky driving behaviors result in higher premiums.

Selecting the Appropriate Deductible

When choosing a car insurance policy, the deductible is another critical factor. A higher deductible often results in lower monthly premiums. However, it’s crucial to consider the trade-off: while you save on premiums, you’ll pay more out-of-pocket in the event of a claim. Balancing your deductible with your financial situation is essential to ensure that you can afford any potential expenses.

However, choosing a very high deductible could leave you vulnerable to significant out-of-pocket expenses in the event of a serious accident, potentially exceeding your financial capacity.

Leading Car Insurance Providers and Their Offerings

USAA Car Insurance

USAA is highly regarded for its excellent customer service and competitive rates, particularly for military members and their families. The company consistently receives high marks for its claims processing and customer satisfaction. However, its availability is limited, making it an option primarily for those eligible. Pros include high customer satisfaction ratings and a variety of discounts tailored for military families, while cons may include the limited demographic it serves.

Conversely, while USAA scores well in customer satisfaction, it may not be an option for many drivers, as it primarily serves military personnel and their families, leaving out a significant portion of the market.

1. https://hikvisiondashcam.vn/archive/1166/

2. https://hikvisiondashcam.vn/archive/1168/

3. https://hikvisiondashcam.vn/archive/1164/

State Farm Car Insurance

State Farm is known for its extensive network and range of coverage options, making it a reliable choice across the nation. The company offers various discounts for safe driving, bundling policies, and even student discounts. Its robust agent network provides personalized service, which many customers appreciate. However, some customers have noted that premiums can be higher compared to other providers, particularly for younger drivers or those with less-than-perfect records.

However, a J.D. Power 2023 customer satisfaction study showed State Farm scoring below the industry average in claims satisfaction, suggesting potential drawbacks despite its wide reach.

GEICO Car Insurance

GEICO emphasizes affordability and has a reputation for low rates. Its user-friendly online tools make it easy for customers to manage their policies, obtain quotes, and file claims. The company also boasts a diverse array of discounts, including those for good students and federal employees. Pros include competitive rates and numerous discounts, while some users report that customer service can be inconsistent, especially during peak claim seasons.

In contrast, while GEICO is often lauded for its pricing, its customer service has been noted as a concern by some users, particularly during high-demand periods, which may affect overall satisfaction.

Nationwide Car Insurance

Nationwide is known for its various discounts, including options for safe driving and multi-policy bundling. It also offers a unique program called On Your Side Review, which helps customers evaluate their coverage needs periodically. This proactive approach can help ensure that your policy remains relevant as your circumstances change. While its rates can be competitive, some consumers find its customer service lacking compared to other providers, particularly when it comes to claims handling.

Moreover, despite Nationwide’s extensive offerings, its customer service ratings indicate some room for improvement, particularly in the claims process, which can be a critical factor for consumers.

Erie Insurance

Erie Insurance often emerges as a strong contender in regional markets, particularly in the Midwest and Northeast. It is celebrated for its affordable rates and customer service. Many customers report high satisfaction levels with Erie, particularly concerning their claims process. Pros include competitive pricing and a wide array of coverage options, while its cons might include limited availability in certain states, making it less accessible for some consumers.

Nevertheless, Erie Insurance, while excelling in customer satisfaction and pricing, may not be a viable option for drivers outside its operational regions, thus limiting its appeal.

Top 10 Cheapest Car Insurance Companies

When searching for affordable insurance, consumers may want to consider the top 10 cheapest car insurance companies. Recent industry data indicates that companies like Erie, GEICO, and USAA frequently appear on these lists due to their competitive pricing and strong customer service ratings. Each company offers unique advantages, and understanding these can help you make a more informed decision.

Securing the Best Rates for Your Needs

Utilizing Online Comparison Tools

One of the most effective ways to find who has the best car insurance rates is by using online comparison tools. These platforms allow you to enter your information and receive quotes from multiple insurers. Accuracy is vital, as providing incorrect details can lead to misleading quotes. Many of these tools also allow you to customize your search based on coverage needs, making it easier to find the right policy at the best price.

Negotiating with Insurers

Negotiation can also play a pivotal role in securing lower rates. Insurers may offer discounts for bundling policies (like home and auto) or for demonstrating safe driving habits. It’s beneficial to regularly communicate with your insurer about potential discounts or changes that could affect your rate. Don’t hesitate to shop around and leverage quotes from other companies to negotiate with your current insurer.

Tips for Drivers with Imperfect Records

For those with less-than-perfect driving records, finding affordable insurance can be challenging. However, some strategies can help mitigate costs:

1. https://hikvisiondashcam.vn/archive/1164/

2. https://hikvisiondashcam.vn/archive/1165/

3. https://hikvisiondashcam.vn/archive/1168/

- Improve Your Driving Record: Taking a defensive driving course can sometimes lead to discounts and help improve your record over time. Many insurers offer incentives for drivers who complete these courses.

- Seek Specialized Insurers: Some companies specialize in providing coverage for drivers with a history of accidents or violations. Researching these options may yield better rates, as they may offer more lenient terms for drivers with imperfect records.

- Consider Minimum Coverage: While not always advisable, opting for minimum coverage can reduce your premium. This decision should be made cautiously, considering the potential risks involved in being underinsured.

Emerging Trends in Car Insurance

The car insurance landscape is continually evolving, influenced by technological advancements and shifting consumer behaviors. Two significant trends have emerged recently: the increasing use of artificial intelligence (AI) in risk assessment and the rise of usage-based insurance (UBI).

The Role of AI in Risk Assessment

Artificial intelligence is playing an increasingly important role in the insurance industry. Insurers are leveraging AI to enhance risk assessment capabilities, streamline underwriting processes, and improve fraud detection. By analyzing vast amounts of data, AI can help insurers identify patterns and predict risk more accurately, allowing for more personalized premiums. This technology not only optimizes operational efficiency but also contributes to more competitive pricing for consumers.

Rise of Usage-Based Insurance (UBI)

Usage-based insurance is gaining traction as insurers seek to reward safe driving behavior. With the help of telematics devices and mobile apps, insurers can monitor driving habits in real-time. This data allows for customized premiums based on individual driving behavior, potentially leading to substantial savings for conscientious drivers. As consumers become more aware of their driving habits and their impact on insurance costs, UBI is likely to become a more popular option.

Managing Your Car Insurance Policy Effectively

Mobile Apps for Convenience

In today’s digital age, many insurance companies offer mobile apps that allow you to manage your policy easily. From paying bills to filing claims, these apps can simplify the insurance experience. They also often provide access to digital ID cards and important policy documents, ensuring you have everything you need at your fingertips. Many apps also feature roadside assistance options, which can be invaluable in emergencies.

Understanding Your Policy

It’s essential to thoroughly understand your car insurance policy, including what is and isn’t covered. This knowledge can prevent surprises during the claims process and ensure you have the appropriate level of protection for your needs. Regularly reviewing your policy can also help you identify any changes in coverage or potential savings through available discounts.

Periodic Policy Reviews

Conducting a periodic review of your policy is crucial, especially after significant life changes such as moving, changing jobs, or purchasing a new vehicle. These events can impact your insurance needs and may allow you to adjust your coverage for better rates. Many insurers offer an annual review process, which can be beneficial in ensuring that your policy is still aligned with your needs and financial situation.

Conclusion

Determining who has the best car insurance rates involves a careful evaluation of personal needs, coverage types, and provider options. By understanding the various components of car insurance, considering top providers, and utilizing comparison tools, consumers can make informed decisions. Regularly reviewing your policy and seeking out discounts can further enhance your ability to secure affordable coverage tailored to your unique situation.

Emerging trends, such as the use of AI and UBI, indicate that the car insurance market is evolving, offering more tailored options for consumers. Whether you are a seasoned driver or new to the road, being proactive in your search for the best rates can lead to significant savings and peace of mind.